All Categories

Featured

Table of Contents

The are entire life insurance and global life insurance policy. The money worth is not added to the death advantage.

After 10 years, the cash money value has actually expanded to roughly $150,000. He secures a tax-free car loan of $50,000 to begin an organization with his bro. The policy financing rate of interest is 6%. He pays back the funding over the following 5 years. Going this path, the rate of interest he pays returns into his policy's money worth instead of a banks.

Visualize never having to fret about small business loan or high rate of interest again. What happens if you could obtain money on your terms and develop riches at the same time? That's the power of boundless banking life insurance policy. By leveraging the money value of entire life insurance IUL policies, you can expand your wealth and obtain cash without relying upon typical financial institutions.

There's no collection lending term, and you have the flexibility to select the repayment timetable, which can be as leisurely as settling the lending at the time of death. This adaptability encompasses the servicing of the lendings, where you can go with interest-only payments, maintaining the lending equilibrium flat and convenient.

Holding money in an IUL taken care of account being attributed interest can typically be far better than holding the money on down payment at a bank.: You have actually constantly desired for opening your very own pastry shop. You can borrow from your IUL policy to cover the first expenditures of renting out a space, buying devices, and working with personnel.

Paul Haarman Infinite Banking

Individual loans can be obtained from standard banks and cooperative credit union. Right here are some crucial factors to consider. Charge card can offer an adaptable way to borrow money for really temporary periods. However, obtaining cash on a charge card is normally extremely expensive with interest rate of rate of interest (APR) usually getting to 20% to 30% or more a year.

The tax obligation treatment of policy car loans can differ considerably relying on your nation of residence and the particular regards to your IUL policy. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, plan loans are normally tax-free, providing a considerable advantage. Nevertheless, in various other jurisdictions, there might be tax obligation effects to consider, such as potential taxes on the financing.

Term life insurance only supplies a death advantage, without any type of cash value build-up. This means there's no money value to borrow versus.

Infinite Banking Definition

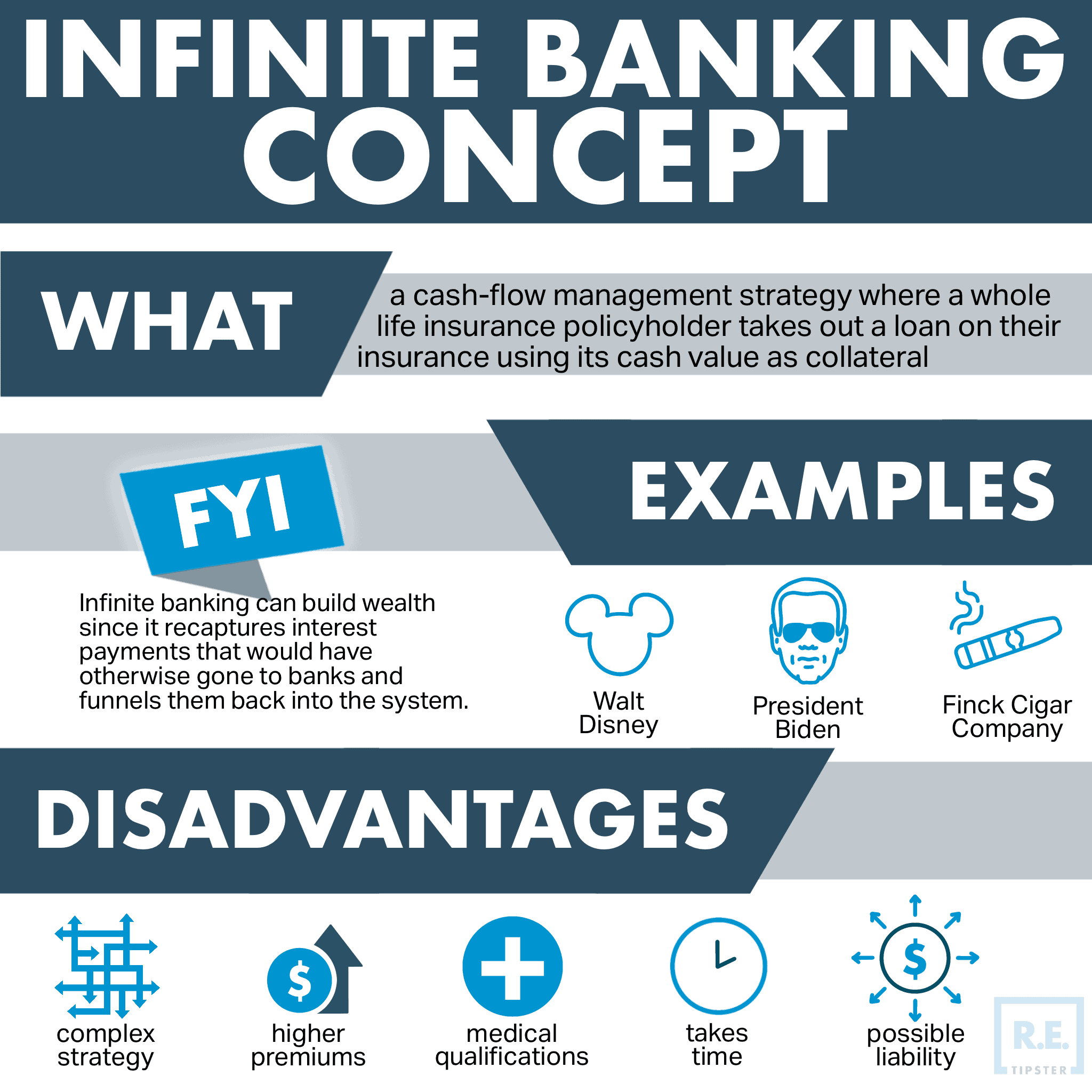

When you initially listen to concerning the Infinite Banking Idea (IBC), your initial reaction may be: This appears too excellent to be true. The trouble with the Infinite Banking Idea is not the concept however those individuals offering a negative review of Infinite Financial as a concept.

As IBC Authorized Practitioners with the Nelson Nash Institute, we thought we would address some of the top questions individuals search for online when discovering and understanding everything to do with the Infinite Financial Concept. What is Infinite Banking? Infinite Banking was created by Nelson Nash in 2000 and totally clarified with the magazine of his publication Becoming Your Own Lender: Unlock the Infinite Banking Concept.

How To Make Your Own Bank

You believe you are coming out economically ahead due to the fact that you pay no passion, but you are not. With conserving and paying money, you might not pay interest, however you are using your cash when; when you invest it, it's gone permanently, and you offer up on the opportunity to gain lifetime compound interest on that cash.

Billionaires such as Walt Disney, the Rockefeller household and Jim Pattison have leveraged the residential properties of whole life insurance policy that goes back 174 years. Even banks use whole life insurance coverage for the exact same purposes. It is called Bank-Owned-Life-Insurance (BOLI). The Canada Profits Company (CRA) even acknowledges the value of participating whole life insurance policy as a special property course made use of to produce long-term equity safely and predictably and offer tax benefits outside the scope of typical financial investments.

R Nelson Nash Net Worth

It permits you to create wealth by satisfying the financial function in your very own life and the capacity to self-finance major way of living acquisitions and expenses without interrupting the compound interest. One of the simplest means to assume concerning an IBC-type participating entire life insurance policy policy is it is equivalent to paying a home loan on a home.

When you obtain from your participating entire life insurance policy, the cash value continues to expand uninterrupted as if you never obtained from it in the very first area. This is due to the fact that you are utilizing the cash money value and death advantage as security for a lending from the life insurance policy firm or as collateral from a third-party lending institution (understood as collateral borrowing).

That's why it's necessary to work with a Licensed Life insurance policy Broker accredited in Infinite Banking that structures your participating entire life insurance plan correctly so you can avoid negative tax obligation effects. Infinite Financial as an economic approach is except everybody. Right here are several of the advantages and disadvantages of Infinite Financial you must seriously consider in choosing whether to move on.

Our favored insurance service provider, Equitable Life of Canada, a shared life insurance policy company, focuses on participating entire life insurance policy plans details to Infinite Financial. In a shared life insurance coverage firm, policyholders are considered company co-owners and receive a share of the divisible excess generated each year via returns. We have a variety of carriers to pick from, such as Canada Life, Manulife and Sun Lifedepending on the demands of our clients.

Please also download our 5 Leading Inquiries to Ask A Boundless Banking Agent Prior To You Hire Them. To find out more about Infinite Financial see: Disclaimer: The material offered in this newsletter is for informative and/or instructional functions only. The information, opinions and/or views expressed in this e-newsletter are those of the authors and not always those of the supplier.

Bank Cipher Bioshock Infinite

The concept of Infinite Financial was developed by Nelson Nash in the 1980s. Nash was a finance professional and fan of the Austrian school of business economics, which advocates that the worth of items aren't clearly the result of traditional financial frameworks like supply and need. Instead, individuals value money and goods differently based upon their financial status and demands.

Among the risks of traditional banking, according to Nash, was high-interest rates on car loans. As well several people, himself included, got involved in financial difficulty due to reliance on financial establishments. As long as banks set the rates of interest and lending terms, people really did not have control over their own riches. Becoming your very own banker, Nash established, would certainly place you in control over your economic future.

Infinite Financial requires you to have your economic future. For ambitious individuals, it can be the ideal financial device ever. Right here are the advantages of Infinite Banking: Probably the single most advantageous facet of Infinite Financial is that it enhances your cash money flow.

Dividend-paying entire life insurance coverage is really reduced threat and offers you, the policyholder, a great offer of control. The control that Infinite Banking offers can best be organized into 2 groups: tax benefits and property securities.

Whole life insurance coverage policies are non-correlated properties. This is why they function so well as the financial structure of Infinite Financial. Regardless of what happens in the market (stock, actual estate, or otherwise), your insurance coverage plan retains its well worth.

Entire life insurance policy is that third bucket. Not just is the price of return on your whole life insurance coverage policy ensured, your fatality advantage and premiums are also assured.

Royal Bank Visa Infinite Avion Rewards

This framework lines up completely with the concepts of the Perpetual Wealth Technique. Infinite Financial attract those looking for better financial control. Here are its major benefits: Liquidity and access: Policy fundings supply prompt access to funds without the restrictions of typical financial institution fundings. Tax obligation performance: The cash value expands tax-deferred, and policy finances are tax-free, making it a tax-efficient tool for constructing wealth.

Property protection: In lots of states, the money value of life insurance coverage is secured from creditors, including an added layer of financial protection. While Infinite Financial has its benefits, it isn't a one-size-fits-all solution, and it features substantial disadvantages. Here's why it might not be the best technique: Infinite Banking typically requires complex plan structuring, which can confuse insurance holders.

Latest Posts

Bank On Yourself Review Feedback

Whole Life Insurance For Infinite Banking

Be Your Own Bank: 3 Secrets Every Saver Needs